As I already pointed out, in any economy

(be it socialist, capitalist, feudal, etc...) that uses money, the

price of goods sends signals to consumers and guide their consumption.

In terms of development, the value that is most crucial is land value.

If land is cheap, then it sends a signal that land is abundant and it

can be wasted without fear of bankruptcy, which results in low-density

developments. If land is expensive, then it signals developers to build

higher densities because land that desirable is rare. Land prices are

what motivates high density developments in a housing market with little

regulation.

But that still leaves one big question: what determines the value of land?

The answer in the end is that the potential profit from developing the land determines its value.

So

if housing is in short supply and so has high prices, then the

potential profit from building new housing is likely to be quite high.

If the market tolerates higher densities, likewise. So without urban

regulations, desirable locations would support higher-density

developments, which would increase land prices and so squeeze out

low-density developments in that location for all but the super-rich.

OK, so that's that, but what are the repercussions of this? How does this contribute to shaping cities?

How zoning and density limits make low-density more affordable and high-density more expensive

First,

let's use a thought experiment with approximate values. Let's look only

at housing, specifically five types of housing: high-rise apartments,

low-rise apartments, townhouses, small detached houses and big detached

houses...

|

| The five housing types of the thought experiment |

Now,

all of these housing types generate income, profit

for the developer who builds and sells them. From the FAR (Floor Area

Ratio), I will estimate some relative income per square meter of land

used to build each housing type, knowing that bigger houses with bigger

lots may tend to have more of a profit margin relative to building cost.

So

if the large detached house has a relative profit level of 100 per

square meter of land, the smaller detached house would have a profit

level of 145, the townhouse would have an index of 190, the low-rise

apartments, an index of 250 and the high-rise, an index of 840.

By

that, I mean that a small detached house would yield 145% of the profit

of the large detached house per square meter of the lot area, so 45%

more.

Now

let's try a first scenario, where there is no zoning and no planning,

let's assume a uniform value of land everywhere (a simplification that

may be valid for a small neighborhood), a value made by averaging all

the indexes of each allowed building type. I supposed a construction

cost of 1 500$ per square meter for all units, except high-rises that

cost 2 500$ per square meter (divide by 10 for square foot, not exactly

that, but close enough approximation), and I supposed that the unit size

are 200 square meters for the big house, 160 for the small house, 120

for the townhouse, 90 for the low-rise apartments and 70 for the

high-rise apartments.

OK,

so enough with the methodology, here are the results, the market price

for each unit type, per unit and per square meter of floor area.

|

| Cost of each unit, per unit and per square meter of floor area, case 1: without zoning |

So

in this case, the lower density housing types are significantly more

expensive, both per unit and per floor area, largely because they

consume more land per unit and per floor area, which increases their

cost as they pay the same price for land as higher density developments.

This provides a financial incentive for higher densities, people who

desperately want lower densities have to go farther away from desirable

spots to find land that is more affordable.

Now, for CASE 2,

what happens if we implement a simple zoning rule: one zone is limited

to single-family housing (including townhouses, yes, they are

single-family housing), the other is limited to multi-family housing.

Here, land value is affected, in the SFH zone, single-family housing

types no longer have to compete with high-density housing types, which

generate more income per square meter of land, so land in that zone,

deprived of the potential for higher profits, will be worth much less. I

will average the indexes only of all single-family housing types for

that zone. In the other, the opposite occurs, since the land where

multi-family housing is allowed is limited and all the competitors for

that land are all multi-family housing too, land value will likely be

much higher there than it would be otherwise, I will average the indexes of

low-rise and high-rise apartments only.

So

in the end, land in the SFH zone is worth 50% less, but land in the MFH

zone is worth 80% more, which has a great impact on unit prices:

|

| Cost of each unit, per unit and per square meter of floor area, case 2:single-family and multi-family separation |

This is a boon for low-density housing,

in the first case, the big houses cost 550 000$ to buy because of the

price of land, which they require a lot of, in the second case, deprived

from the competition of multi-family housing, the cost falls to nearly

400 000$. On the other hand, apartments become significantly more

expensive, as they are left to bid up land prices in a limited zone with

other highly profitable developments. Low-rise apartments suffer most,

they cost about 160 000$ in the first case, but nearly 190 000$ in the

second, they even become more expensive than big houses per square meter

of floor area. Note that this experiment supposes that planners provide

enough land for both housing types, if they give one the short end of

the stick by restricting their zone area too much, they may create a

shortage and drive prices up.

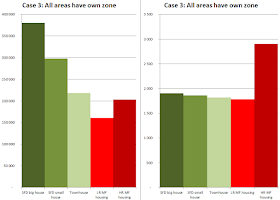

Now, let's go on to CASE 3; in this case,

we go even further along in the separation of each housing typology.

Each housing type has its own zone. Like in case 2, this favors

lower-density housing types, which are protected from competing for land

with other housing types, so land prices are lowest where only

low-density housing is allowed, and highest where only high-density

housing is allowed.

|

| Cost of each unit, per unit and per square meter of floor area, case 3:all housing types have their own zone |

In this case, the cost per square meter

of each housing type represents the construction cost, not surprisingly.

The big houses are now even more affordable than they used to be at 380

000$, however, smaller houses become more expensive than in the previous scenarios. Low-rise apartments, not having to compete with high-rises anymore,

see their land costs fall significantly, which is a boon to them.

In

this case, there is no financial incentive to economize land, because

zones are built to make low-density housing impervious to the waste of

their higher land consumption, since the zoning makes more profitable

and optimal use of that land illegal. The cost of housing reflects only construction cost and unit size, the cost of land per unit is largely equal, no matter how much land each unit consumes.

For, CASE 4,

let's look at case 2, but with an added regulation: a minimum lot size

of 800 square meters (a bit over 8 000 square feet, or a fifth of an

acre).

In

this case, I assume that townhouses actually are semi-detached houses,

two on a single 800-square-meter lot. Anyway, here, the minimal lot size

largely impacts single-family housing, making the main cost advantage

of smaller houses on smaller lots moot, further depressing land value.

|

| Cost of each unit, per unit and per square meter of floor area, case 4: Single-family and Multi-family separation plus minimum lot sizes |

The

biggest victim of this regulation financially speaking is the small

detached house, which becomes only marginally less expensive than the

bigger house, and more expensive per square meter of floor area. An

additional effect is a fall in FAR for apartments, who see themselves

forced to have bigger lots, but no more units. This doesn't affect their

costs much, because it represents a fall in potential profit from

development, which reduces the value of land. In the scenario I

conceived, apartment density falls by about 30%.

Now, a famous regulation for CASE 5, high minimum parking requirements, added to single-family-multi-family segregation.

I

will presume only off-street surface parking here, not considering the alternative of on-street parking or of underground parking, which is extremely expensive

(on average 30 000$ per space). This surface parking doesn't affect

either detached house, because they have sufficiently big lots already

to have driveways without increasing their lot area. However, this

forces once again townhouses to become semi-detached houses in order to

accommodate driveways.

|

| Two townhouses to the left become semi-detached houses to have driveways if they are required to have 2+ off-street parking spaces |

One

impact of this is that the density of low-rise and high-rise apartments

collapses, as they are forced to consume more land to have parking lots

for their residents. As a result, FAR of low-rise apartments fall from

90% to 60% and FAR of high-rise apartments fall from 210% to about 90%.

|

| Cost of each unit, per unit and per square meter of floor area, case 5: Single-family and Multi-family separation plus minimum parking requirements |

This

is not so different from case 2, except that it hides a significant

fall in density, which has little impact on price because even if housing

types consume more land, that land is worth less than it would have

since more profitable alternatives (ie housing with less or no parking) are illegal. In effect, this

regulation may reduce density by 40-50%, and also reduces land prices by

40-50%.

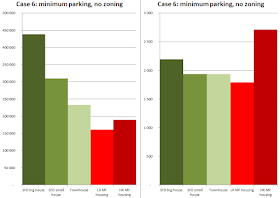

But what happens if you presume no zoning, but only minimum parking requirements? That is CASE 6.

Here is the effect:

|

| Cost of each unit, per unit and per square meter of floor area, case 6: No zoning, but minim parking requirements |

Here,

as lower-density uses are no longer protected from higher-density uses,

prices for low-density housing are much higher, however, they are

nowhere near the prices of the first case (without zoning nor

regulation), because the higher-density uses are of significantly lower

densities than in the case without parking requirements. Since profit

per square meter of land is capped, land value is capped... at least

until land shortages force all prices up.

For those who want a real-life example of how minimum parking requirements reduce land value, then look at page 10 from the High Cost of Free Parking.

In the case of Oakland, parking requirements reduced land values by 33%

and density by 30% just 2 years after implementation, which seems to

indicate that my little thought experiment isn't so far from the truth.

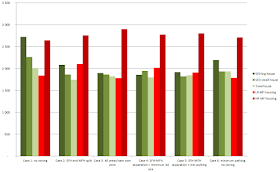

So, to sum up:

|

| Total unit cost per scenario |

|

| Cost per square meter of floor, per scenario |

|

| Cost variation, where case 1 (no zoning, no regulation) = 100% |

So

as you can see, zoning, minimum lot size and minimum parking

regulations all create financial incentives for lower-density housing.

They reduce the land cost of low-density housing by protecting them from

having to compete with higher density uses for the land. On the other

hand, they make high-density housing either more expensive or much less

dense. As a result of these two factors, the average FAR that is built

may go from 80-90% to 30-40%, because cheaper low-density housing

incites people to buy more of them and higher-density housing's density

gets limited. This results in population density falling by 3 or 4

times.

It's

important to point out that though density limits make land prices

fall, the price of housing overall remains largely constant because

housing requires more land. So if land is worth half as much but you

need two times more, then it has no effect on cost overall.

I

guess if some want to push people into low-density housing, and don't

care about financially sustainable and walkable communities, it doesn't

matter much, or it may even be a positive effect of modern zoning and

planning regulations. But for urbanists, this is a damning demonstration

of the effect of modern zoning regimes.

Note

also that though this effect is probably true, land shortages due to

density limits will rise land prices overall, "a rising tide lifts all

boats". But even if land prices triple or quadruple, zoning will still

have the same effect of keeping land prices for lower-density options

lower and encourage people to buy them This effect may seem paradoxical:

density limits lower the price of land then increase them? But that is

logical, in a situation of "plenty" with a lot of land to develop,

density limits lower the value of land, in situations of shortage, where

developable land is hard to find, the situation is reversed, density

limits aggravate the shortage and so land prices.

That

is why sprawl is dependent on highway construction to open up more

lands for development. Since sprawl quickly fills out available land, if

more land isn't found to develop, it will quickly choke in land

shortages. So the solution of sprawl is to "create" more land, by making

travel faster so as to bring developments closer and make land that

used to be considered too far for development more desirable. This is the ideal of "mobility" of defenders of sprawl.

A couple of other caveat emptor:

1-

I presumed that land value without zoning would average the different

housing types, but speculators may actually hold off of selling their

land until they can get the highest possible return on it (high-rises),

so land prices may be even higher than expected. The solution to that is

to make it more expensive to hold land by implementing land value

taxation.

2-

I presumed land value being uniform over the study area, but in

reality, land values will vary from one neighborhood to the other,

depending on their desirability. So in practice, absence of regulation

may lead to highly variable land value depending on location, with

high-rises going after highly desirable locations and shoving other housing types away. In extreme cases, I guess it could result in some kind

of spontaneous separation of housing typologies.

Commercial areas

This

conclusion is valid also for commercial areas, especially regarding

minimum parking requirements. High minimum parking requirements which

result in FAR of commercial areas of being just 10 to 20%, most of the

rest being parking lot, significantly reducing the amount of

revenue-producing area that can be built, since parking, if free,

generates no revenue for the owner (but has expenses linked to it).

|

| Commercial area in Phoenix, FAR of about 20% |

|

| Supermarket with parking lot in car-friendly Obihiro in Japan, FAR 50% |

Though

these regulations increase land consumption, they also reduce land

prices. As a result, there is little effect on the overall price of

building commercial areas, however, higher land consumption means a loss

of potentially fertile land, more infrastructure and service costs and

less tax base to pay that infrastructure.

Conclusion

As

I've repeated a lot, in a money-based economy, prices represent

information regarding resource consumption to guide consumers into wiser

choices for themselves and the community. By protecting lower-density

developments from competing with higher-density developments through

modern zoning and urban regulation, this signal is distorted, prices are

skewed in favor of low-density developments. This leads more people to

choose that type of housing, even when higher density uses aren't

outright banned (as they too often are). Forcing developments to compete

on a level playing field would undeniably result in denser, more

sustainable communities being built.

I just came back from Australia, and noticed the incredibly high value of land (the government limits the supply of developable land), where even in the suburbs and tiny towns the cost of land is often greater than the cost of building the house.

ReplyDeleteBut, despite the high value of land, most of the country is still built in an car-oriented format, which I believe is due to to things:

a) Zoning. Even if some areas are locally dense, they are purely residential and often not within walking distance of destinations, so you still need to drive to get between land uses.

b) Too much investment in car-infrastructure, too little investment in transit.

Two differences I noticed during my trip to Australia:

- During my road trip, I discovered that most (but not all, found some counter examples) small towns are still very Main Street-centric. If you look at a zoning map, the only area where retail and offices are allowed is often only along their main street.

- There was incremental intensification everywhere. Like townhomes mixed with single family homes. My aunt and uncle knocked down their suburban home, divided their lot into three very narrow lots, and build 3 town homes, and profiting from it by selling 2 while still living in 1 of the town homes.

Australia and New Zealand do seem to allow lot subdivision to a greater extent than many American and Canadian cities. That seems to include not just making the lot narrower but also sectioning off the back of the lot into 1-2 new lots with a driveway to the back of the lot. They also seem to allow sideways oriented townhouses.

ReplyDeleteThis sort of incremental intensification is common in Hungary too (and perhaps Japan as well?). Lots in most of Canada seem to be both narrower and shallower than in Australia/NZ but there's still some that are large enough that this could work if it was allowed. I would say typical lot sizes in Canada are about 40-60ft wide and 90-150ft deep, going down to about 15-30ft wide and 90-120ft deep for denser urban cores. In Montreal and Quebec the lots in the urban cores might be a bit wider and shallower since that's more practical for the duplexes/triples that are common there. I think American cities are generally similar to english Canada in the urban cores, but with larger lots in the suburbs since unlike Australia and many Canadian cities there's less of a limit to the supply of developable land.

I suspect that there's still places in Australia like the inner "suburbs" of Sydney and Melbourne where it would make sense to go denser, maybe 3-5 stories, or even high-rise in desirable downtown cores, but I'm not sure how often the zoning allows that. Parking requirements can also be a factor.

Are there any textbooks that subject North American zoning to this sort of rigorous analytical treatment? I think you may be writing the first draft. I had a post from a few years back identifying the same "paradox," using an example from Nashville: http://oldurbanist.blogspot.com/2011/09/zoning-paradox.html

ReplyDeleteI really liked this example at the time as it controls for all factors, including location, schools, street pattern, etc., except for zoning, in side-by-side areas zoned for 12 units/acre (duplexes) vs. 80 units/acre and/or offices. Allowed density varied by a factor of close to 7, while assessed land values varied by a factor of 6, keeping in mind that this is an area close to the CBD of a 1 million+ metro area. (Since that post, apartment development in the upzoned area was so intense that the city actually placed a moratorium on all new construction in the zone, which has temporarily destroyed land values and made properties unmarketable: http://www.tennessean.com/story/money/2015/02/18/music-row-moratorium-mcclain-towery-metro-planning/23630859/)

What the SF/duplex zoning seems to be doing in that area is encouraging slow redevelopment into very large and expensive homes on fairly large lots, while the MF zoning is (or was) resulting in much smaller and cheaper apartment units despite higher cost/square foot ($200 vs. $300) due what I suspect are demand-based reasons, rather than anything having directly to do with construction cost. In other words, zoning policy is subsidizing urban SFD housing for the wealthy and upper middle class. I suspect SFD on very small lots would be an appealing third option, but it is not one that zoning allows.

So fascinating. I have never though about land and the economy in this way. I live in a big city and just thought that because most of the jobs are here, people just decided to squeeze together so they don't have to drive as far. The zoning aspect of it I really had no clue about before I read this.

ReplyDeleteDaniel Roberson @ Mark Bentley PA