Recently, Charles Marohn from the organization Strongtowns (a pro-urbanist organization that is focused on financially sustainable urbanism, especially small midwestern American towns) published an

article about height limits. In it, he spoke about a possible justification for a certain type of height limits that is different from a purely aesthetic argument as is commonly heard. He said that allowing buildings that are very high in areas with plenty of vacant lots can incite the lot owners to ask for much more than they would otherwise for their lots, thus delaying development until another developer figures there is a reason to build high-rises on the site.

This is actually similar to something I mused about on my

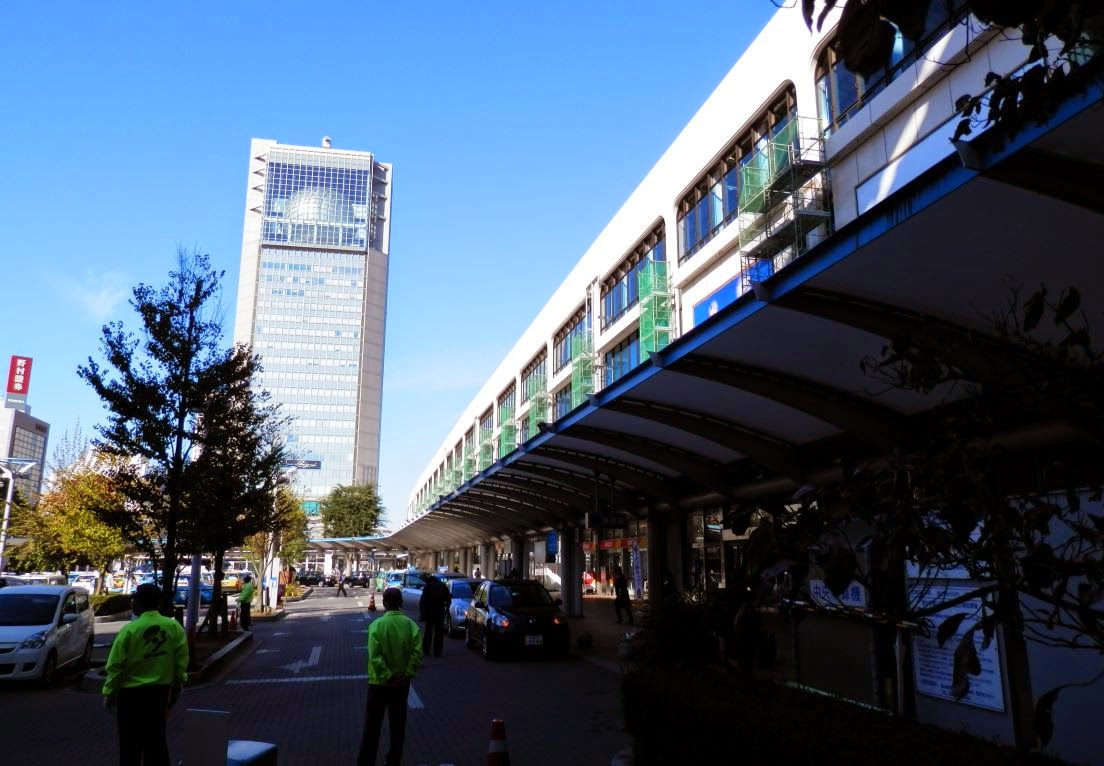

post about the point of zoning. Indeed, the value of lots is influenced by how much profit can be made developing it, so allowing higher density developments do increase land value, especially if high density developments is allowed only in a select few areas. This might contribute to the "stonehenge" feel of some areas I saw in Sapporo on my trip there:

|

| "Stonehenge"-style of development in Sapporo, 10+-story towers next to vacant lots and parking lots |

|

He then recommends a dynamic form of height limits, where height is limited not arbitrarily but in relation to the height of adjacent buildings, he suggests 50% higher than the average of the buildings on adjacent lots. Which, again, strangely echoes my own musings about

dynamic zoning.

First things first, the good thing about this idea: it supposes that cities must evolve rather than be set in stone and gradually become denser. It also encourages the construction of tight urban fabric and small-scale redevelopment. And it might indeed be sufficient to tame densification in certain sensitive areas to make it more palatable.

However, is it really a good idea everywhere?

Economics of redevelopment

The biggest issue I have with the 50% rule (yes, even if I came up with it myself too) is that if you take an uniform area all with 2-story buildings where demand for housing outstrips supply, 50% increase in density is not going to allow for affordable new units (not unless you can add floors to existing buildings). Each new unit in redeveloped buildings has to incorporate in its price part of the value of the units it replaces.

For example, if a 2-story building is worth 400 000$, a 3-story building built over it will need to incorporate that 400 000$ in its sale value, so if the new building has three units and each of these units cost 150 000$ to build, then they will need to be sold for 290 000$ at a minimum to be profitable, that is nearly twice the cost of building a similar building in a greenfield development. That is a significant barrier to redevelopment.

|

| Curb showing how more expensive redeveloped units are in relation to construction costs and the allowed density increase |

But the reality is even worse. In the previous example, I supposed that the current value of houses was equal to their construction cost. That is correct in balanced housing markets where there is plenty of land to develop and supply can organically grow to respond to demand, but in places in high demand where redevelopment is more likely, that's not the case at all, housing is in shortage and its value will therefore likely be higher than the initial construction cost.

Furthermore, if I was correct in my earlier posts and that the ceiling of value of housing in a given area is defined by the marginal cost of building new housing, then that means that if the cost of building new units is much higher than the construction cost of the existing units, then the market value of existing housing will be free to increase up to the cost of building new units, for the economics don't support redevelopment until market value goes over the cost of redevelopment.

What I mean is that if in the uniform 2-story area each unit is worth 150 000$ and building a new unit to the same construction standard in a 3-story building would cost 250 000$... who would actually buy those units when they could have units worth 150 000$ instead? These new units will not move, unless people are willing to pay 250 000$ for them, and if they are, then that means that the value of all the existing units, barring massive flaws and disrepair, would also be 250 000$. In other words, it's only when existing unit prices will be 250 000$ for existing units that it will become worthwhile to build new units...

BUT WAIT! There's more. Since the value of existing units influences the cost of building new units, it means that if current units are worth 250 000$, then the cost to build new units in 3-unit buildings is no longer 250 000$, but rather 315 000$! So now existing units can increase in value to 315 000$ before building a 3-unit building in replacement of a 2-story building becomes worth it... but if that's the case, then the cost of building these new units is now up to 360 000$!

Ouch! I still have good news for you: it converges at one point. At one point the cost of building a new unit does become equal or lesser than the current market value of existing units. At what point?

Here's the graph that shows at what point it happens.

|

| Ratio to construction cost at which point a new unit built in replacement of existing units can cost less to build than current value of existing units (dotted red line is the previous graph) |

So for example, if you allow only a 50% density increase (2 to 3 units) and the cost of building each unit is 150 000$, excluding land costs, then the value of existing units can be 3 times as high before it becomes profitable to build new units (ratio of 300%). So units will need to increase in value to 450 000$ before you start seeing some redevelopment that is affordable for the people who could afford to live there at current prices (if you are willing to move upmarket by building luxury units, redevelopment can occur sooner).

Gradualism the like of what was proposed in the Strongtowns article thus has a terrible flaw: it is economically unaffordable. Filtering may help to some extent, with existing units falling in value because newer units are seen as more desirable, so it needs not be that bad, but even then, we are far from affordable housing for all. The economics of redevelopment may make such a rule almost completely ineffectual, unless housing prices are extremely high.

No possibility for higher densities where needed

One of the big problems of such a blanket rule would be that areas can't simply leapfrog the steps of density. For instance, if you have just built rapid transit passing through a low-density area, the rule would allow only for a small increase in density, far less than would actually be required to take full use of the area's opportunity. But you need to be able to concentrate as many stores, jobs and residents near transit stations to make them worthwhile and reduce the need of cars to reach popular destinations.

So to increase density very fast, developers would have to build a taller building, then build an even taller next door and destroy the first building to build an even taller one. Needless to say, that's absurd. I don't believe the idea that buildings should be eternal, I've defended the Japanese way of treating housing as depreciating goods like cars, but even I recognize that you want your housing to stay up at least 20 years, otherwise it's a complete waste.

|

| The Rosslyn-Ballston corridor in Arlington, a Washington DC suburb. The area went from a suburban commercial strip to this after the subway came, it didn't go through progressive 2-,4-,6-story phases to get there. It is one of the rare suburbs in North America where population has increased, jobs have increased and traffic has gone down |

The problem of such a rule for transit-oriented developments was brought forth to Charles Marohn by many, including by me. However, it turns out that he didn't see it as a bug in his system, more like a feature. Marohn doesn't believe in TOD, he explicitly said in a discussion:

"I'm not an advocate of TOD but instead DOT, development-oriented transit."

He frequently calls cities building rapid transit lines to areas where the current state of development doesn't justify rapid transit currently a "gamble" with public money and is strictly opposed to it. So if I understand his position correctly, he wants development to first grow to a sufficient density to support rapid transit, then it may be built. So his rule in that approach is not a problem at all, areas where high-quality transit will be built will already have high density, so 50% more of high-density is quite sufficient in his mind.

Now with all due respect, I would ask: how exactly is this "development-oriented transit" any different from what we've been doing for the past 70 years? This is why there was so much dearth of actual transit investments. Rapid transit generally requires more density to be financially viable than car-oriented developments can support. So of course, in an era of car-oriented development, the only areas that got transit were areas built before the car in old streetcar suburbs. So that idea is nothing new and, especially, a sure approach for failure from my point of view.

Not only that, but I think his approach is also a gamble. Because if (despite my predictions) density does get high enough to justify rapid transit, then that rapid transit line will be supremely expensive to build through an high-density area with sky-high land prices. Almost the only way to build a rapid transit through such an area is underground, which costs 200 to 400 million dollars per km.

On the other hand, if you build rapid transit on the surface before the area gets built up too much, then the cost of construction for a line that offers similar speed and level of service is probably around 30 to 50 million dollars per km, almost 8 times cheaper. 8 times cheaper also means that the density level justifying the line is also 8 times smaller. So putting off transit investments is also a gamble, but instead of betting on transit as a major way of getting around, you're instead betting that it will never be justified and that cars will remain the long-distance transport mode forever. If an area grows so much it now requires rapid transit and you have put off investments for years, then you have lost the bet: you thought you could save money by not investing in transit, and you were wrong, now you have to build transit at 2 to 8 times the price of what it could have been if you had invested money earlier, or your city will choke on cars.

The presence of rapid transit stations also give developers a reason to build density around them, when it would be much cheaper for them instead to let old neighborhoods die and to build in greenfield areas where land is cheaper.

For example, the strong regional train system in Japan is no stranger to the fact that all cities develop mainly around their local station. The presence of the station is what draws developments there and it allows people to be free to go to any city without using cars.

|

| Japan's JR rail networks (doesn't include private lines) |

|

| Down this street, the Kitami train station, which creates a strong downtown area even in this city of 126 000 people. |

In fact, one of the first informations on real estate listings on Japanese websites, after the price and the number of rooms, is how far to the nearest station the unit is.

|

| Example of apartment listing on Suumo.jp, with information about nearest train stations front and center, this apartment is in Furano, a town of about 25 000 people, far from any big city |

Salvaging incrementalism

Still, I think I may understand where Marohn is coming from. An engineering background may explain why both he and I find attractive the idea of simple rules to follow in every situation rather than byzantine arbitrary regulations that carve up cities and countries in tiny pieces where rules vary based on no quantifiable criterion. The kind of absurd situation where one lot may have an height limit of 3 stories when the one next door has an height limit of 2 stories, simply because some planner decided to do it that way without reason way back when and now you need to actively work to change it.

So can incrementalism be saved while taking into account the economics of it and allowing for TOD, bursts of increased density leapfrogging the stages of development, while achieving Marohn's aims to favor the construction of urban fabric rather than stonehenge-style development?

I think so.

The way to do this in my view is that instead of making the height limit dependent on adjacent buildings, it would vary first and foremost by what is present on the lot currently. Meaning that instead of going by the average height of adjacent buildings, you'd use a multiple of the height of the current building, or better yet, by its FAR (floor area ratio: the sum of the area of each floor divided by the lot area). And in order to keep prices from raising too high, going by the second curve I posted, I would recommend an allowance for twice or thrice current FAR, with a preference for thrice.

For vacant lots, buildings should be limited to the average height of current buildings or to 2 stories (or 40% FAR). This way, keeping a vacant lot would be a waste, because the profit linked to the development of it would be strictly limited to relatively low-density developments, since only developed lots could be transformed into high-density developments.

What would this mean?

Well, let's rake a typical bungalow (all models made in Sweet Home 3D that I've diverted from its true purpose and towards making up different densities and building dense neighborhoods):

This is about 25-30% in FAR, so a 150 square meter (1500 square foot) house on a 600 square meter lot.

If you want to replace this bungalow with higher densities, you could go for row houses...

|

| Three row houses with parking spaces on a driveway, FAR 60-70% |

...or go the multi-family route with a triplex:

|

| Triplex, FAR 70-80% |

If the triplexes and row houses no longer suffice, then they can be converted to 3-story, 12-condo buildings, with a FAR of around 200%.

Later on, you could go even taller if needed.

What of TOD and higher density "bursts" then? Well, you could put a rule saying that any developer that wishes to go beyond thrice the FAR of the actual building to pay a penalty fee equal to the value of the current property times the ratio between the current FAR of the building and the needed FAR it would need to be able to build the future development.

Okay, an example would be better...

Let's say you have a 2-story duplex worth 600 000$ and a developer wants to build a 9-story condo tower in its stead. Normally, with a "3 times FAR" rule, only a 6-story building would be allowed (supposing the same lot coverage). The building on the lot would have needed to have 3-stories for it to be allowed. In other words, the current building should have 50% more stories to allow the 9-story building, so the developer has to pay a development fee of 50% of the current value of the duplex in order to have the permit to build the 9-story condo tower, in this case, that's a 300 000$ development fee.

There, you have an incremental rule that:

- Keeps the value of land down for vacant lots to favor development of them

- Allows for incremental density in reaction to demand

- Makes sure that increased density is sufficient to maintain housing somewhat affordable even when built by replacing existing housing

- Allows a way for developers in areas with exploding demand to go beyond the incrementalism when they need to leapfrog the stages of development